Rajkumar has 22+ years of experience in banking/NBFC operations at a senior level. He has specialized in risk management and business development. He was previously associated with BPL, ICICI Bank and Reliance Capital.

Meet Our Leadership Team

Mr. Arulanandam C

Chief Technology Officer

Mr. Rajendran M

Lead - MLAP Operations

Mr. Raja Mohamed A

Lead - Recovery Collections

Mr. Balaji Kumar

Company Secretary

Mr. Murukanantham K S

Lead - Legal

Mr. Ramachandran S

Finance Controller

Mr. Arun Prakash R

Lead - Internal Audit

Mr. SathishBabu V

Lead - Credit MSME MLAP / TW

Mr. Santhosh Kanna R

Lead – Collections (TW&MSME MLAP)

Mr. Muthukumar S

Lead - Treasury & Fund Raising

Mr. Balachandar K

Business Lead - MSME MLAP

Mrs. Annai Josephine G

Lead - HR

Mr. Shajanraj S

Lead - Call Centre Collection & Customer Service Delivery

Mr. Rajkumar R

Sales Lead - TW

Mr. VenkateshBabu T

Lead – Training & Repayment Management

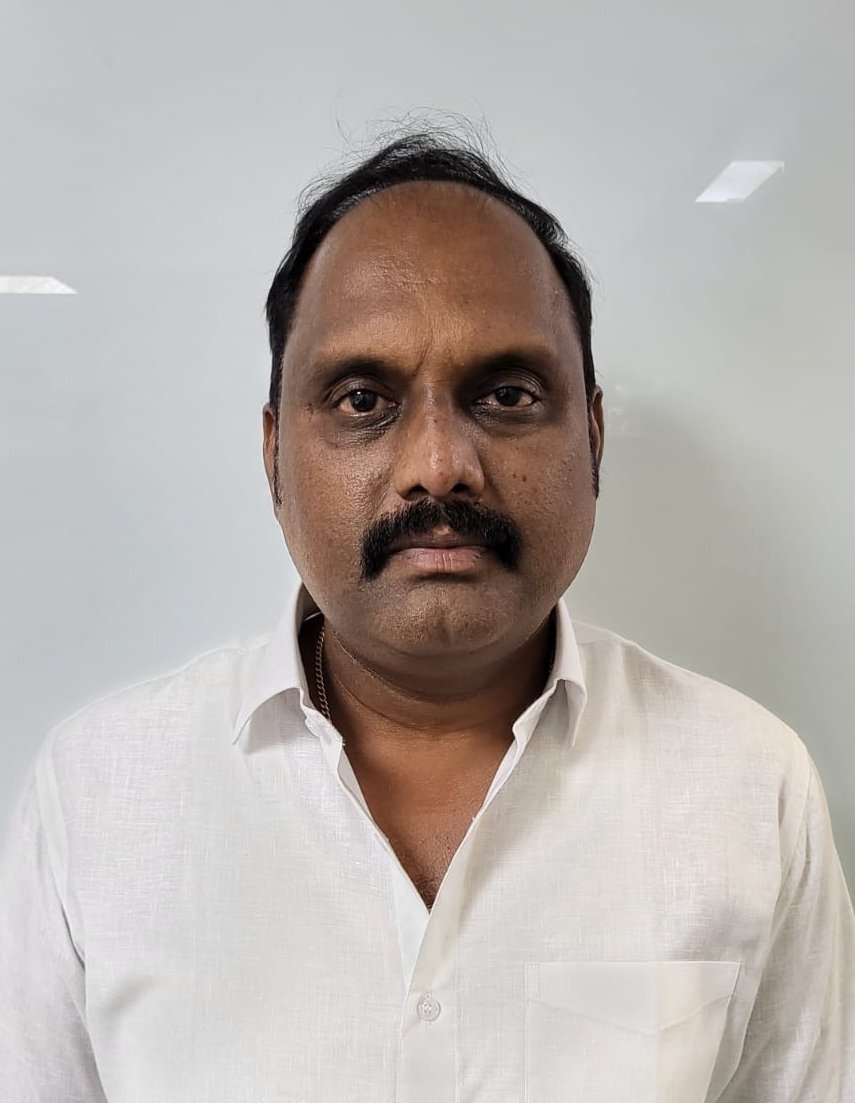

Mr. Rajkumar M

CRO

Mr. Arulanandam C

Chief Technology Officer

Mr. Arulanandam is an Information Technology professional with over 30 years of diverse experience across Banking/NBFC operations, IT services, Manufacturing, and the Electronics Industry. He has predominantly worked in the NBFC sector, both with deposit and non- deposit-taking organizations.

He played a key role in automating various business domains, including Corporate and Retail lending, Deposits, Shares, Customer Service, Microfinance, and MSME portfolios, using relevant technologies for each domain. Mr. Arulanandam was instrumental in the digital transformation of an NBFC by automating manual processes, implementing the best tech stack, and enabling the organization to handle business transactions with a book size of over 17,000 Crores.

Mr. Rajendran M

Lead - MLAP Operations

Mr. Rajendran M is a seasoned MLAP (Loan Against Property) operations professional with over 23 years of diverse experience in Banking and NBFC operations. He has predominantly worked in the NBFC sector, where he has managed the end-to-end operations related to MLAP products, ensuring the seamless processing, approval, and disbursement of loans. His expertise includes overseeing all operational aspects of MLAP, such as application processing, documentation, risk assessment, and ensuring compliance with regulatory guidelines.

Mr. Rajendran plays a pivotal role in driving the optimization of processes, enhancing operational efficiency, and ensuring that all MLAP transactions are completed accurately and on time. He collaborates closely with internal teams, including credit, legal, and risk, to ensure smooth coordination and timely decision-making. Additionally, he focuses on identifying and mitigating operational risks, improving customer experience, and contributing to the overall business growth by meeting performance targets and maintaining a high standard of service.

Mr. VenkateshBabu T

Lead – Training & Repayment Management

Mr. VenkateshBabu T is an experienced professional with over 35 years of diverse experience across Banking/NBFC operations, IT services, and the Electronics industry. He has predominantly worked in the NBFC sector, where he has developed and implemented comprehensive training programs to enhance the skills and knowledge of employees across various departments. He specializes in assessing training needs, designing curricula, and delivering engaging training sessions to improve performance and drive organizational growth.

In addition to his role in training management, Mr. VenkateshBabu oversees the entire repayment lifecycle of loans, ensuring that payments are collected, recorded, and processed efficiently and accurately. He manages overdue accounts, negotiates repayment plans, and addresses payment-related issues. He collaborates with internal teams, including collections and customer service, to optimize repayment processes and improve recovery rates. With strong financial acumen, excellent communication skills, and the ability to lead and motivate teams, Mr. VenkateshBabu is instrumental in achieving repayment goals and ensuring compliance with company policies and regulations.

Mr. Rajkumar R

Sales Lead - TW

Mr. Rajkumar R is an experienced professional with over 28 years of diverse experience across the Banking and NBFC sectors, particularly in the two-wheeler segment. He has predominantly worked in the NBFC sector, where he has overseen and driven sales operations within the two-wheeler business. His expertise lies in developing and executing strategies to expand market share, enhance sales performance, and drive revenue growth by promoting and selling two-wheeler products.

Mr. Rajkumar works closely with the marketing, product, and operations teams to understand customer needs, identify market opportunities, and deliver tailored solutions. He is skilled in building and nurturing relationships with key dealers, stakeholders, and customers, ensuring excellent customer service and achieving sales targets. Additionally, Mr. Rajkumar tracks market trends, analysis sales data, and leads his team to exceed sales goals, contributing significantly to the success and growth of the two-wheeler division.

Mr. Shajanraj S

Lead - Call Centre Collection & Customer Service Delivery

Mr. Shajanraj S is an experienced professional with over 24 years of diverse experience across the telecommunications, Banking, and NBFC sectors. He has predominantly worked in the NBFC and Telecom industries, where he has overseen and managed the entire call centre operations, focusing on collections and customer service delivery across the organization. In this capacity, he leads teams to ensure timely and efficient collections from customers, optimizes call centre operations, and continually enhances customer service experiences.

Mr. Shajanraj is skilled in developing and implementing strategies to improve collection rates, reduce outstanding balances, and ensure compliance with legal and regulatory requirements. Additionally, he manages customer service delivery, ensuring that customer interactions are handled effectively and fostering positive customer experiences across all touchpoints. He collaborates closely with internal teams to align strategies with company objectives, monitors key performance indicators (KPIs), and ensures the efficient resolution of customer queries or issues. With strong leadership skills, a deep understanding of call centre operations, collection strategies, and customer service excellence, Mr. Shajanraj contributes significantly to the organization’s success.

Mrs. Annai Josephine G

Lead - HR

Mrs. Annai Josephine G is a seasoned Human Resource professional with over 12 years of diverse experience across Banking/NBFC operations and Telecommunication Industry. She has predominantly worked in the NBFC sector, overseeing the human resources function within the organization. In this capacity, she has ensured the effective management of talent acquisition, employee engagement, performance management, and organizational development.

Mrs. Annai Josephine leads HR strategies that support business objectives, foster a positive work culture, and ensure compliance with labour laws and regulations. She works closely with senior management to align HR initiatives with the company’s goals, focusing on employee retention, training, and development. Additionally, she plays a key role in driving organizational change, managing employee relations, and implementing best practices for performance management. With strong leadership skills, a deep understanding of HR processes, and a passion for fostering a productive and harmonious work environment. She contributes significantly to the organization’s success.

Mr. Balachandar K

Business Lead - MSME MLAP

Mr. Balachandar K is a seasoned mortgage professional with over 19 years of diverse experience in Banking and NBFC operations. He has predominantly worked in the NBFC sector, where he has overseen and managed the development, execution, and performance of MSME lending programs, with a strong focus on the MLAP (Micro Loan Against Property) segment.

Mr. Balachandar plays a crucial role in designing and implementing strategies to provide financial products and services to MSMEs. He works closely with internal teams to assess market opportunities, manage risks, and enhance the portfolio performance of MSME loans. By optimizing operational processes and driving business growth, he ensures the effective implementation of the MLAP strategy. Additionally, he maintains strong relationships with key stakeholders, including clients, partners, and regulatory bodies. With a deep understanding of MSME lending, market dynamics, and credit risk management, Mr. Balachandar contributes significantly to the overall growth and success of the business.

Mr. Muthukumar S

Lead - Treasury & Fund Raising

Mr. Muthukumar S is an experienced professional in Finance and Accounts including Treasury & Fund Raising domains, with over 25 years of diverse experience across Banking and NBFC operations. He has primarily worked in the NBFC sector, where he has managed the organization’s liquidity, funding, and investment strategies. His expertise includes overseeing cash flow management, optimizing financial resources, and ensuring the company has sufficient funds to meet both its operational and strategic goals.

Mr. Muthukumar is skilled in developing and executing strategies for raising capital through various financial instruments, including debt, equity, and structured finance. He collaborates closely with senior management to assess financial risks, identify funding requirements, and maintain strong relationships with banks, investors, and other financial institutions. Additionally, he manages treasury operations, ensures compliance with financial regulations, and supports the company’s overall financial stability and growth.

Mr. Santhosh Kanna R

Lead – Collections (TW&MSME MLAP)

Mr. Santhosh Kanna is an experienced collection operations professional with over 20 years of diverse experience across Banking and NBFC operations. He has predominantly worked in the NBFC sector, overseeing and managing collection operations, with a specific focus on accounts transitioning from the X (initial stage) to the 3 (final stage) of the collection lifecycle.

Mr. Santhosh Kanna has been instrumental in developing and executing strategies to recover outstanding debts, ensuring compliance with legal and regulatory requirements, and optimizing collection processes for maximum efficiency. He leads a team to assess and prioritize accounts, manage negotiations with customers, and implement effective strategies to reduce overdue receivables. His strong data analysis skills ensure that the collection process aligns with business goals while driving improvements to maximize recovery rates. Additionally, he works closely with other teams to mitigate risks and enhance the overall performance of the collections function.

Mr. Raja Mohamed A

Lead - Recovery Collections

Mr. Raja Mohamed is a seasoned Sales and Collection professional with over 25 years of diverse experience across Banking/NBFC operations, Manufacturing, and the Electronics Industry. He has predominantly worked in the NBFC sector, playing a pivotal role in managing and overseeing the recovery operations of outstanding debts across various portfolios.

Mr. Raja Mohamed has been instrumental in driving the company’s financial health by minimizing overdue receivables and optimizing recovery rates. He has successfully enhanced key business domains, including Corporate and Retail lending, by implementing strategies that efficiently recover dues while ensuring full compliance with legal and regulatory requirements. His ability to optimize collection processes has played a significant role in minimizing risk and maximizing recovery.

Mr. Magesh Kumar

MSME MLAP Credit

Mr. Balaji Kumar

Company Secretary

Mr. Balaji Kumar is a seasoned professional with over a decade of extensive experience in Secretarial practices, RBI regulations, and Corporate & Allied Laws. With a strong background in the Non-Banking Financial Company (NBFC) sector, he has played a pivotal role in ensuring compliance with regulatory frameworks, streamlining governance structures, and upholding the highest standards of corporate legal adherence.

His expertise spans across a wide range of critical functions, including regulatory coordination, investor relations, corporate governance, and complaint management. He has successfully led compliance initiatives, ensuring accurate and timely regulatory reporting while mitigating legal risks and fostering transparency in business operations. With a keen eye for detail and a solution-oriented approach, he continues to contribute to the operational excellence and governance standards of organizations in the NBFC domain, reinforcing their credibility and long-term sustainability in a dynamic financial landscape.

Mr. Murukanantham K S

Lead - Legal

Mr. Murukanantham is a seasoned legal professional with over 15 years of diverse experience in Banking and NBFC operations. He has predominantly worked in the NBFC sector, where he has overseen and managed the legal affairs of the organization, ensuring compliance with all applicable laws and regulations.

Mr. Murukanantham has played a pivotal role in providing strategic legal guidance, dispute resolution, and risk management. He has also advised on matters related to corporate governance, intellectual property, and regulatory compliance. Additionally, he has managed legal teams, coordinated with external counsel when necessary, and contributed to the development of policies that protect the organization’s legal interests. His expertise in the legal landscape, combined with his exceptional negotiation skills, allows him to provide clear and actionable legal advice to senior management.

Mr. Ramachandran S

Finance Controller

Mr. Ramachandran S is an experienced finance professional with over 25 years of diverse experience across Banking and NBFC operations. He has predominantly worked in the NBFC sector, where he has overseen and managed the financial operations of the organization, ensuring the accuracy, integrity, and timeliness of financial reporting. His expertise includes preparing financial statements, managing budgets, forecasting financial performance, and ensuring compliance with accounting standards and regulations.

Mr. Ramachandran plays a pivotal role in driving the financial strategy, optimizing internal controls, and managing risks. He coordinates with internal and external stakeholders, including auditors and regulatory bodies, to ensure the financial health and stability of the organization. With strong analytical skills, attention to detail, and the ability to lead financial operations, Mr. Ramachandran contributes significantly to the company’s long-term growth and success.

Mr. SathishBabu V

Lead - Credit MSME MLAP / TW

Mr. SathishBabu is a seasoned credit professional with over 17 years of diverse experience across Banking and NBFC operations. He has predominantly worked in the NBFC sector, where he has overseen credit operations within the MSME (Micro, Small, and Medium Enterprises) sector, with a specific focus on the implementation and management of the MLAP (Micro Loan Against Property) and TW (Two Wheeler) strategies.

Mr. SathishBabu has been instrumental in managing credit assessments, conducting risk evaluations, and ensuring compliance with lending guidelines. He has played a key role in streamlining credit processes, enhancing portfolio performance, and ensuring the effective utilization of technology in credit management and workforce optimization. Additionally, he drives business growth through strategic credit decisions, fosters strong relationships with internal teams, and delivers on key performance indicators. His expertise in technology integration and risk management has contributed to achieving the company’s broader business goals.

Mr. Arun Prakash R

Lead - Internal Audit

Mr. Arun Prakash is an experienced Internal Audit & RCU (Risk Control Unit) professional with over 20+ years of diverse experience in Banking/NBFC operations and IT services. He has predominantly worked in the NBFC sector, overseeing and managing the internal audit and risk control functions of the organization, focusing on developing and implementing audit strategies to evaluate the effectiveness of internal controls, ensuring compliance with regulatory requirements, and identifying operational risks.

Mr. Arun Prakash has been instrumental in managing Audit assessments and works closely with senior management to provide insights and recommendations for improving processes, mitigating risks, and enhancing organizational efficiency. Additionally, he leads theteam to monitor, assess, and address potential risks that may impact the company’s operations. With his expertise in audit processes, risk management, and compliance, Mr. Arun Prakash plays a key role in influencing key decision-making and contributing to the organization’s overall risk management framework.

MR.Shibi C Sreenivasan

Chief Financial Officer

Chartered Accountant with more than 15 year's qualitative experience Specialised in Treasury, Budgeting, Receivables, MIS, Risk and Forex management, Investments, Working capital funding, Long term funding & Compliance.